Geico Car Insurance - Your Road To Smarter Protection

Thinking about your car, and how you keep it safe on the road, often brings up thoughts of protection. You want to feel secure, knowing that if something unexpected happens, you have a reliable plan in place. For many folks, finding the right kind of shield for their vehicle, something that truly fits their life and their wallet, is a pretty big deal. This is where a company like Geico comes into the picture, offering a way to look at what might work for you without any pressure.

When it comes to getting your vehicle covered, the idea of a simple process, one that doesn't ask for too much of your time or energy, sounds pretty good, doesn't it? People are often looking for ways to make their everyday tasks just a little bit easier, and managing something as important as insurance should be no different. This is where the promise of a straightforward experience, from getting an initial look at costs to handling your policy later on, really makes a difference for people trying to balance all their daily responsibilities. You know, it's about making life flow a bit more smoothly.

So, as we talk about what it means to have good vehicle protection, we can explore how a company like Geico works to meet those everyday needs. We'll touch on how they help you figure out what kind of plan makes sense for your particular situation, how they make it easy to take care of things online, and why so many people have put their trust in them for a very long time. It's about getting a clearer picture of how their approach might just be what you're looking for to keep your ride secure.

Table of Contents

- Finding Your Perfect Fit for Geico Car Insurance - How Do You Get Started?

- Is Geico Car Insurance Really That Easy to Manage Online?

- What Makes Geico Car Insurance a Trusted Choice?

- Saving Money on Geico Car Insurance - What's the Secret?

- Understanding Geico Car Insurance Quotes - What Should You Look For?

- Connecting with Geico Car Insurance Support

- Personalizing Your Geico Car Insurance in North Carolina

- Meeting Your Local Geico Car Insurance Agent

Finding Your Perfect Fit for Geico Car Insurance - How Do You Get Started?

When you're thinking about getting your vehicle covered, a really good first step is to get a sense of what's available and what it might cost. You want to find something that truly feels like it was made just for you, something that covers what you need without adding extra bits you don't. Geico makes it simple to get a free look at what they offer, so you can start to piece together the kind of protection that makes the most sense for your daily drives and your peace of mind. It's just a quick way to begin seeing your options, you know?

The idea of a "free car insurance quote" is pretty straightforward. It means you can ask Geico to give you an estimate of what your coverage might cost, and you don't have to pay anything to get that information. This initial look helps you understand the different levels of protection that are available and how they might fit into your personal situation. It's about giving you the details you need to make a well-informed choice about keeping your vehicle safe, without any obligation to move forward. So, it's almost like trying on a new pair of shoes before you buy them, just for your car's safety plan.

Getting a plan that "best fits your needs" means finding a set of protections that matches your unique way of life. Maybe you drive a lot for work, or perhaps your car mostly sits in the driveway. Your situation is different from everyone else's, and your coverage should reflect that. Geico aims to help you discover those options that feel just right, like a comfortable glove, for your particular circumstances. They want to make sure you're not paying for things you don't need, but also that you have enough security for when you really do need it. That's a pretty important consideration, wouldn't you say?

From the very start, Geico tries to offer a way to get coverage that feels truly personal. They focus on giving you choices that can be shaped to what you're looking for, rather than just a one-size-fits-all approach. This commitment to making sure you have the proper shield for your vehicle is something they really stand by. It's about providing a service that understands that every driver and every car is a little bit different, and so their protection plans should be, too. In some respects, it’s about making sure you feel truly looked after.

Is Geico Car Insurance Really That Easy to Manage Online?

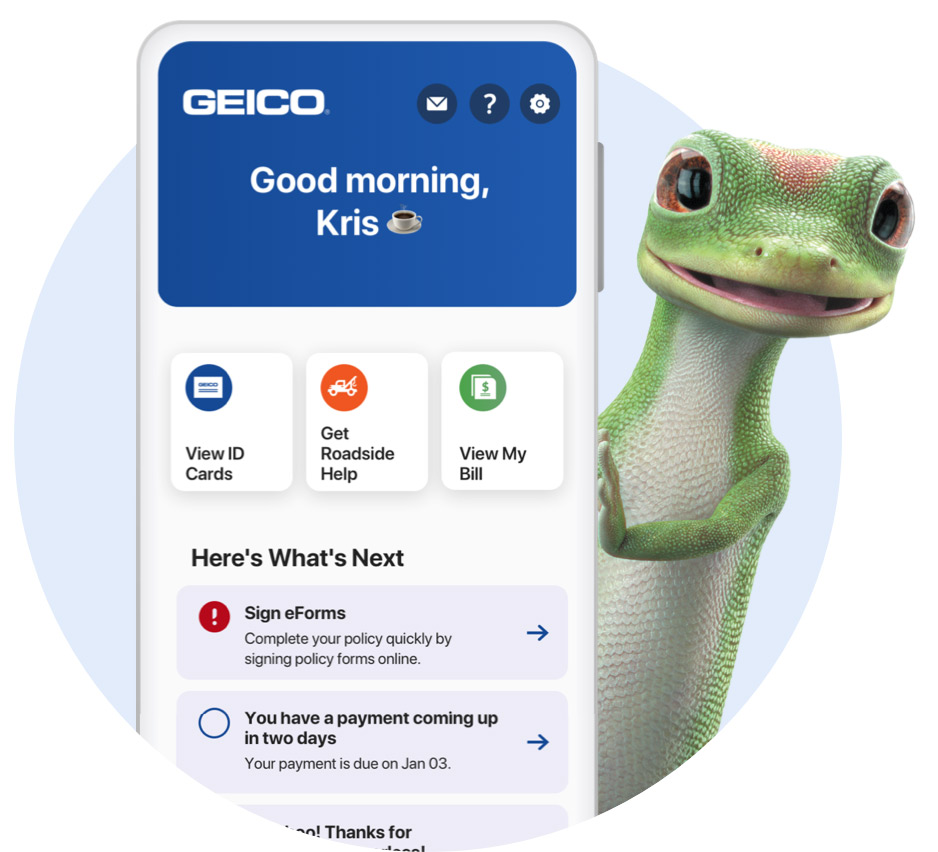

When you think about handling your insurance, it's often nice to know you can do it without a lot of fuss. Maybe you're at home, maybe you're out and about, but having the ability to look after your policy from wherever you are, that's just a little bit convenient, isn't it? Geico makes it quite simple to take care of your policy details online. It means you don't have to wait for office hours or sit on the phone for ages. You can just hop on your computer or phone and sort things out pretty quickly. This kind of access, it really makes things simpler for folks who have busy schedules or just prefer to handle things on their own time. So, it's almost like having a personal assistant for your policy, right there when you need it.

One of the everyday tasks you might need to do is make a payment. With Geico, you can handle your bills right there on their website or through their app. This means you can pay your monthly or yearly amount whenever it suits you, without having to mail a check or call someone up. It's about giving you the freedom to manage your money in a way that fits your schedule, which can be a real time-saver for many people. This digital way of handling things just makes life a bit less complicated, you know?

Another thing you might need to do is get your insurance identification cards. These are the little pieces of paper or digital files that show you have coverage, and you often need them for things like vehicle registration or if you get pulled over. Geico lets you grab these instantly online. You don't have to wait for them to arrive in the mail. This immediate access is really helpful if you're in a hurry or just need proof of coverage right away. It's quite a handy feature, honestly, for those moments when you just need something quickly.

Sometimes, life changes, and you might need to add or take away a vehicle from your policy. Maybe you bought a new car, or perhaps you sold an old one. Geico's online tools let you make these kinds of adjustments yourself, without having to go through a lot of back-and-forth. This ability to update your coverage as your life changes is pretty important, as a matter of fact. It means your protection stays current with what you own, giving you peace of mind that everything is properly accounted for.

Beyond just payments and adding or removing cars, there are often other small things you might want to do with your policy. Geico's online system allows for "and more," meaning there are various other little tasks you can handle digitally. This broad range of online capabilities means you have a good deal of control over your insurance details, right at your fingertips. It's about putting the power to manage your own coverage directly into your hands, which, you know, can feel pretty empowering.

What Makes Geico Car Insurance a Trusted Choice?

When you're choosing a company to protect something as valuable as your car, you want to pick one that has stood the test of time. Geico has been around for a very long while, since 1936, actually. That's a lot of years of helping people with their vehicle protection needs. This kind of long history often means a company has learned a great deal about what works and how to serve its customers well. It suggests a certain level of reliability, doesn't it? It’s pretty reassuring to know a company has been doing this for so many decades.

Being "trusted since 1936" means that generations of drivers have relied on Geico for their coverage. It speaks to a consistent presence and a steady hand in the insurance business. Over all those years, they've likely seen a lot of different situations and have built up a lot of experience in helping people through them. This kind of long-standing reputation can give you a good feeling about choosing them for your own protection. You know, it shows they've been doing something right for a very long time.

Geico, which stands for Government Employees Insurance Company, has been focused on providing vehicle protection that doesn't cost an arm and a leg since it first started in 1936. Their goal has always been to make good coverage accessible and affordable for people. This commitment to offering rates that are easy on your budget is a big part of why so many people have come to depend on them over the years. It's about getting solid protection without having to spend too much, which is pretty much what everyone hopes for, right?

The idea that you "can trust Geico to offer low car insurance rates" is a core part of their promise. They aim to be a source for vehicle protection that is both dependable and kind to your wallet. This focus on providing cost-effective options has been a consistent part of their approach for a very long time. It suggests that they work to find ways to keep costs down for their customers, which, honestly, is a pretty attractive quality when you're trying to manage your household budget. They really try to give you good value for your money, in a way.

Saving Money on Geico Car Insurance - What's the Secret?

Everyone likes to save a little bit of money, especially on something like vehicle protection. It’s pretty natural to want to get the best deal you can without giving up on good coverage. Geico often talks about how much people can keep in their pockets when they choose them for their car, motorcycle, and other vehicle protection needs. The "secret," if you can call it that, is often about how they structure their offerings and their commitment to providing competitive pricing. It’s about making your money go further, which is something we all appreciate, you know?

When you look into what Geico offers, you can often "see how much you can save" on different types of protection. This isn't just about your everyday car. They also offer ways to protect your motorcycle, and even other kinds of vehicles. This broad range of options means you might be able to bundle things together or find specific plans that really cut down on your overall costs. It’s about finding those places where you can trim your expenses without feeling like you’re losing out on important security. So, it's almost like a little treasure hunt for savings, in a way.

Understanding Geico Car Insurance Quotes - What Should You Look For?

Getting a quote for your car protection is more than just looking at a number; it's about really figuring out what goes into that number. When you're comparing different options for your vehicle's safety plan, it's important to know what factors play a part in the cost. Geico encourages you to "learn about car insurance quote comparison" so you can truly grasp what you're seeing. This helps you to make sense of the different prices you might get from various places. It's about being smart about your choices, you know?

To "discover factors you need to understand to compare auto insurance rates accurately across providers" means taking a closer look at the details. This could involve things like the kind of vehicle you drive, where you live, your driving history, and even the specific types of coverage you choose. Each of these bits of information can influence the price you're quoted. By understanding these influences, you're better equipped to see why one quote might be higher or lower than another, and to make sure you're comparing similar levels of protection. It’s pretty much about being an informed shopper, which is always a good thing.

Connecting with Geico Car Insurance Support

Sometimes, you just need to talk to someone about your protection plan, or you have a question that's a bit tricky to answer on your own. Geico makes it easy to get in touch with their customer service and support team for "all your insurance needs." They offer several ways to reach out, so you can pick the one that feels most comfortable or convenient for you. It's about making sure you can get the help you need, when you need it, which is pretty important for peace of mind, wouldn't you say?

You can reach out through a quick chat online, which is great if you have a simple question and want a fast answer. Or, if you prefer to talk things through, you can pick up the phone and speak directly with someone. Email is another option if your question isn't urgent and you prefer to have a written record. And for those who like a face-to-face conversation, you can even connect with them through a local agent. This variety of ways to get help just shows that they want to be there for you, however you prefer to communicate, which is a pretty good sign of service, honestly.

Beyond just general questions, Geico also has "specific phone numbers for individual insurance products and services." This means if you have a question about, say, your motorcycle protection, there might be a direct line for that, helping you get to the right person more quickly. It's about streamlining the process so you don't have to bounce around trying to find the right department. This kind of focused help can really make a difference when you're trying to sort something out, you know?

Personalizing Your Geico Car Insurance in North Carolina

Every person is unique, and so are their needs when it comes to protecting their vehicle. This is especially true when you consider things like where you live and what your budget looks like. In places like North Carolina, Geico works to make sure your vehicle protection plan is truly "personalized" to fit your individual needs and what you can comfortably afford. They aim to help their customers "find the best coverage options" that truly make sense for them. It's about getting something that feels just right, not something that's forced on you.

The idea of "personalizing North Carolina car insurance policies" means taking into account the specific rules and common situations in that area, along with your own life circumstances. It’s about crafting a plan that considers your daily commute, the kind of car you drive, and how much you want to spend. They want to help you discover how much protection you can get that genuinely fits your situation, rather than just offering a standard package. This kind of thoughtful approach can really make a difference in how secure you feel on the road, you know?

When you're looking for a vehicle protection plan, it's not just about the cost; it's about getting the right amount of security for your budget. Geico works to help customers in North Carolina "find the best coverage options" that balance both these things. They want to make sure you have enough protection for peace of mind, but also that the cost isn't a burden. This focus on finding that sweet spot for each person is pretty much what everyone hopes for when they're looking for a good plan, isn't it?

Meeting Your Local Geico Car Insurance Agent

While handling things online is super convenient for many, sometimes you just want to talk to someone in person. For those who prefer a more direct, face-to-face conversation, Geico makes it possible to "find a local insurance agent near you." This means you can go to an actual office and speak with someone who can help you with your questions and concerns. It's about having that human connection, which can be really reassuring for some people when they're talking about something as important as their vehicle's safety plan. So, it's almost like having a neighbor who can help you out, in a way.

Visiting "Geico's offices to get more information for car, motorcycle, and home insurance needs" means you can sit down and have a detailed chat. This can be particularly helpful if you have complex questions or just prefer to go over things with someone who can look you in the eye. It's not just about your car, either. These local agents can also help you understand options for your motorcycle or even your home. This broad range of help available in person can be a real comfort for those who appreciate a more traditional way of doing business, you know?

Having a local agent means you have a specific person or team you can go to with your questions about Geico car insurance. They can provide personalized guidance and help you sort through the details of your policy. This kind of dedicated support can make a big difference, especially if you're someone who likes to build a relationship with the people who help manage your important affairs. It’s pretty much about having a consistent point of contact for your vehicle’s protection, which can feel very reassuring.

Why consumers love Geico car insurance - Insurance

Lance & Brittany: The Life of The McGee's

GEICO | Welcome to GEICO!