Erie Insurance - Your Reliable Protection Partner

Finding a reliable way to protect the things that matter most in your life can feel like a big decision, so it's almost a relief to discover options that truly stand out. Whether you are looking to safeguard your home, your car, your business, or even your family's financial future, finding good value and dependable support makes a real difference. That kind of steady assurance is what many folks seek when thinking about what an insurance provider can offer them.

People often look for more than just a policy; they want a sense of calm, knowing that someone has their back if something unexpected happens. This means having access to help when you need it, whether that involves getting a quick price check or reaching out to a person who can answer your questions. It really comes down to making the whole process feel less like a chore and more like a straightforward step toward peace of mind, you know?

From sorting out a quick price estimate online to having a friendly face nearby to talk things over, the way a company connects with you shapes your whole experience. This approach, which focuses on making things easy and understandable, tends to build a stronger connection with people. It’s about being there for folks, offering clear paths to help them make sensible choices about their coverage, which is pretty much what everyone wants.

Table of Contents

- Getting to Know Erie Insurance

- What Kinds of Protection Does Erie Insurance Offer?

- Connecting with Erie Insurance - How Simple Is It?

- Finding Your Local Erie Insurance Agent

- Starting Your Erie Insurance Quote Online

- Managing Your Erie Insurance Account

- What If I Need to Change My Erie Insurance Policy?

- Handling Your Erie Insurance Windshield or Roadside Needs

- Why Trust Your Protection to Erie Insurance?

- Keeping Your Erie Insurance Account Safe (Security Update)

Getting to Know Erie Insurance

When you think about protecting your possessions, your family, or your livelihood, it’s only natural to want options that offer a good deal without cutting corners on support. Erie Insurance, as a matter of fact, provides quite a range of coverage choices, from keeping your home safe to looking after your vehicle, and even helping businesses manage their risks. They also offer plans that support your family's future, which is pretty much a big deal for many people.

The idea is to give people access to dependable coverage that fits their individual needs, whether those needs are for a personal car, a family dwelling, or even a small company. You want to feel confident that the protection you choose is both suitable and fairly priced. This approach, honestly, seems to resonate with a lot of folks who are just looking for straightforward, helpful solutions for their various concerns. It’s about being able to rest a little easier, knowing you have a safety net.

Having a variety of choices means you can pick what makes the most sense for your particular situation. So, if you own a house, drive a car, or run a small shop, Erie Insurance has different ways to help you stay covered. This kind of flexibility is quite important, allowing people to combine different types of plans to get a complete package that works for them. It’s about making sure you’re ready for whatever comes your way, you know?

What Kinds of Protection Does Erie Insurance Offer?

People often wonder about the specific types of protection a company can provide, and it's a fair question, as a matter of fact. Erie Insurance makes available a selection of plans for different parts of your life. This includes ways to cover your life, which helps protect your loved ones financially. They also have options for your house, giving you peace of mind about your living space. For those who drive, there are plans for your car, too it's almost a given.

Beyond personal coverage, Erie Insurance also offers ways to protect your business, which is a big help for entrepreneurs and company owners. This means they look out for various kinds of property and situations, making sure you have a broad spectrum of choices. So, whether you're thinking about your personal well-being or the stability of your commercial activities, there are solutions to consider. They aim to cover quite a bit, really.

The aim is to provide good rates across these different types of coverage. This means that for your life, home, business, or auto needs, you can expect competitive pricing. This focus on value is pretty important to many people who are trying to manage their finances while still getting the protection they need. It’s about making sure you get a fair deal for the peace of mind you are seeking, which, honestly, is what most people are after.

Connecting with Erie Insurance - How Simple Is It?

When you are looking into getting some kind of protection, a really important part of the process is how easy it is to actually get started. Nobody wants to jump through hoops just to find out what their options are, right? Erie Insurance, it seems, has put some thought into making that first step pretty straightforward. You have a couple of main paths you can take to begin figuring out your coverage needs, which is quite convenient, you know?

One way you can begin is by reaching out to someone local, a person who works with Erie Insurance and is right there in your community. This can be a helpful approach if you prefer talking things over face-to-face or if you have specific questions that you feel are better answered in a personal conversation. Having that local connection can make a big difference for many people, providing a sense of trust and accessibility. It's about getting that personal touch, basically.

Another option, for those who like to do things from their computer or phone, is to start the process online. You can begin to get a price estimate that way, which is really handy if you’re busy or just prefer to do things at your own pace. This flexibility means you can pick the method that feels most comfortable and efficient for you, which, honestly, is what most people are looking for in today's busy world. It's about putting the choice in your hands, in a way.

Finding Your Local Erie Insurance Agent

For many people, having a local person they can talk to about their protection is a huge plus. It’s comforting to know there’s someone nearby who understands your community and can offer advice that feels personal. Erie Insurance really puts an emphasis on this, making it easy to find an agent close to where you live. These agents are independent, which means they can give you advice that feels genuinely focused on your best interests, you know?

These local, independent agents are there to help you make sensible choices about your protection. They can explain things clearly and help you sort through what might seem like a lot of different options. It’s like having a trusted advisor right in your neighborhood, someone who can guide you through the process of picking the right kind of coverage for your specific situation. This personal touch is, frankly, something many people truly value when it comes to important decisions like these.

The idea is that you can rely on these individuals to provide support and information. They are equipped to answer your questions and help you understand what each type of protection means for you and your family. So, if you’re someone who appreciates a human connection and personalized guidance, finding an Erie Insurance agent nearby is definitely a path worth considering. It's about building a relationship, basically, with someone who can offer ongoing help.

Starting Your Erie Insurance Quote Online

For those who prefer a quicker, more immediate way to explore their options, starting a price estimate online is a very convenient choice. You can simply go to their website and begin the process right away, which is pretty much what many people appreciate in our busy lives. This means you can get an idea of what your protection might cost without having to pick up the phone or leave your house, which is quite a time-saver, honestly.

The online tool is designed to be straightforward, allowing you to input some basic information and get a sense of the rates for the different types of protection Erie Insurance offers. This can be a great first step if you’re just exploring or if you already have a good idea of what you need. It gives you a quick snapshot, letting you see if their offerings align with what you’re looking for in terms of value and coverage, which is very helpful.

So, whether you're thinking about protection for your car, your home, or something else, the online option provides a simple way to get started. It’s available whenever you are, meaning you can do it late at night or early in the morning, whenever it fits into your schedule. This kind of accessibility is really important for busy individuals and families, making it easier to take that initial step toward securing your assets. It’s about flexibility, essentially.

Managing Your Erie Insurance Account

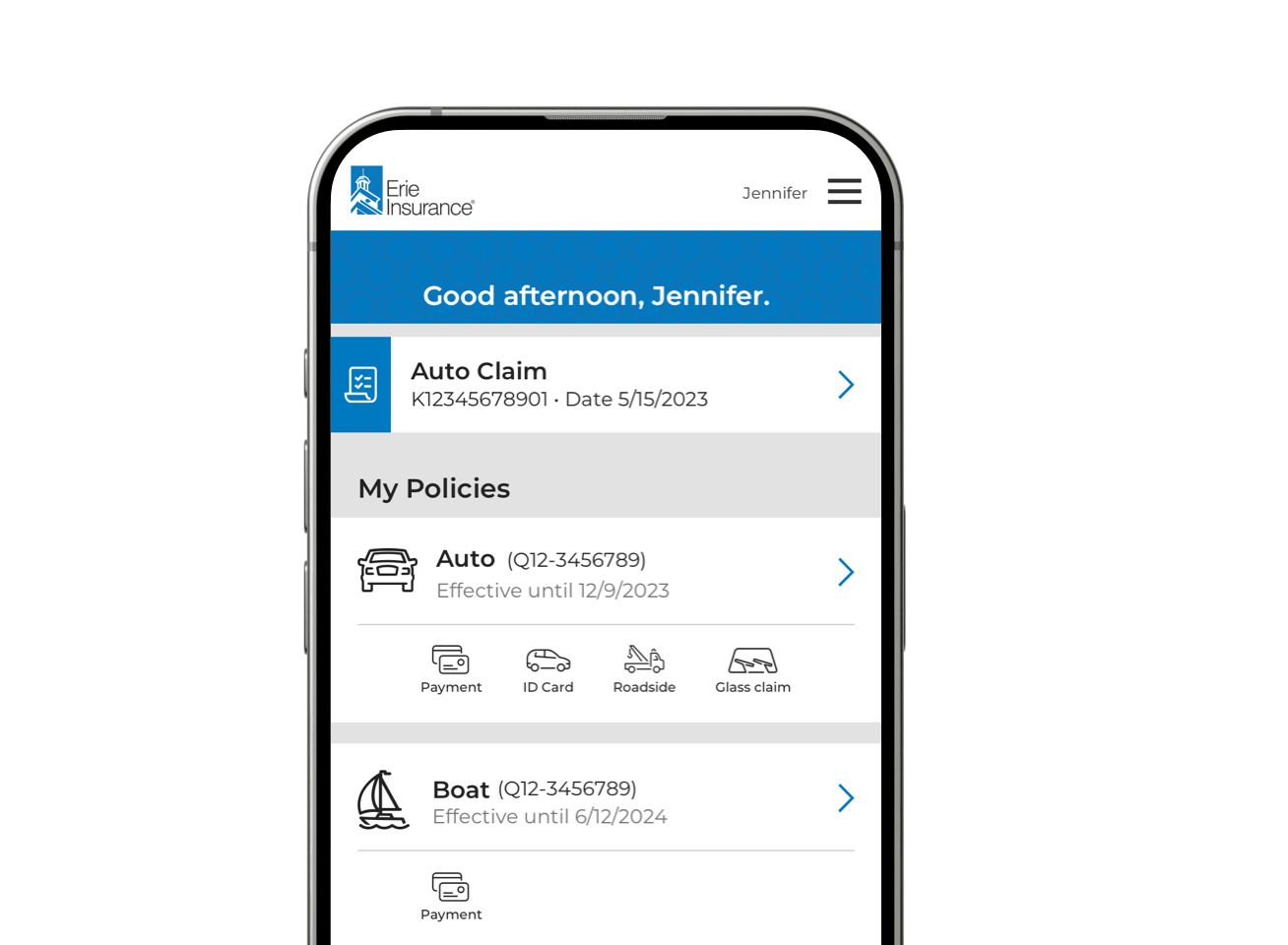

Once you have your protection set up, being able to manage your account easily is, frankly, just as important as getting started. People want to be able to access their information, pay their bills, and handle any changes without a lot of fuss. Erie Insurance understands this, and they have worked to make sure that customers can get to their account details online, which is quite convenient for most folks these days, you know?

They recently shared an update that online account access, including the ability to pay bills, has been brought back after a network issue. This is pretty good news for anyone who relies on digital tools to keep track of their affairs. It means you can log in and take care of what you need to, from checking your policy details to making a payment, all from your computer or mobile device. This restoration of service is, in a way, a sign of their commitment to keeping things running smoothly for their customers.

Being able to handle these things yourself, whenever you want, gives you a lot of control and flexibility. It means you don't have to wait for business hours or make a phone call for every little thing. This kind of self-service capability is something many people appreciate, as it fits into their busy lives and allows them to manage their protection on their own terms. It’s about making things simple and accessible, basically, for everyone.

What If I Need to Change My Erie Insurance Policy?

Life changes, and sometimes your protection needs to change right along with it. Maybe you got a new car, or you moved to a different house, or perhaps your business has grown. When these things happen, you'll likely need to adjust your coverage. So, how do you go about making those kinds of changes with Erie Insurance? It's pretty straightforward, actually, as they direct you to your local agent for these sorts of requests.

If you need to make changes to your existing policy, like updating your vehicle information or adjusting your coverage amounts, your local Erie agent is the person to contact. They can help you with all sorts of policy adjustments, making sure your protection still fits your current situation. This personal assistance is really helpful because they can walk you through the options and make sure everything is handled correctly, which is very reassuring for many.

This also applies if you need to cancel a policy or if you just have general questions about your coverage. Instead of getting lost in automated phone menus, you can reach out directly to someone who knows your policy and can provide specific answers. This approach tends to make the process much less frustrating and more human-centered, which is what you want when dealing with important matters like your protection. It’s about having a dedicated point of contact, basically.

Handling Your Erie Insurance Windshield or Roadside Needs

Sometimes, unexpected things happen while you're out on the road, like a chipped windshield or a flat tire. When these situations pop up, you want a clear and easy way to get help. Erie Insurance has made sure there are a couple of straightforward ways to report a windshield or auto glass problem, or to get assistance if you're stuck on the side of the road, which is quite helpful for drivers, you know?

For windshield or auto glass problems, you have a few options, which is pretty convenient. You can simply give them a call, which is a classic way to get things sorted. If you prefer to use your phone, you can also file your auto glass claim using their mobile app, which is a very modern and quick way to do it. And for those who like to use their computer, there's also an option to file your auto glass claim online, right from their website. This flexibility means you can pick the method that works best for you at that moment, which is really good.

Then there's the roadside assistance, which is option two. If your car breaks down, you run out of gas, or you need a tow, this is the service you would use. Having these clear choices for common car troubles means you can get help quickly and without a lot of stress. It’s about providing practical support when you’re in a pinch, making those unexpected moments a little less disruptive. This kind of support is, frankly, what many people look for in a protection provider.

Why Trust Your Protection to Erie Insurance?

When you are making choices about who will protect your important possessions and your family's future, a big question often comes up: why this company over another? It's a fair thing to consider, as you want to feel confident in your choice. Erie Insurance, it seems, works to build that trust through its commitment to its customers and its approach to service. They aim to be a dependable presence for you, which is very important for many people.

Part of that trust comes from the way they handle things when there are bumps in the road. For instance, when they had a network issue, they kept people informed and worked consistently to get things back to normal. This kind of steady effort to restore services, like online account access and bill pay, shows a dedication to their customers' convenience and security. It’s about showing up and fixing things, basically, when challenges arise.

Another big reason people might feel good about trusting Erie Insurance is their focus on local, independent agents. These individuals are right there in your community, ready to help you make good decisions about your protection. This personal connection, combined with their efforts to keep online services running smoothly and securely, paints a picture of a company that genuinely cares about providing reliable support. It’s about being there for you, in a way, through different channels.

Keeping Your Erie Insurance Account Safe (Security Update)

In today's connected world, keeping your personal information and online accounts secure is a top concern for everyone, and protection providers are no exception. Erie Insurance recently had an information security incident, which they shared an update about on June 27. What's important to note is their response to this situation and their focus on getting things back to normal operations, which is quite reassuring, you know?

They reported that they are making consistent progress toward resuming normal operations. This means they are working steadily to ensure that all their systems are running as they should be, and that customer access is safe and sound. The emphasis here is on doing things securely, which is, frankly, what everyone wants when their personal details are involved. It’s about taking the necessary steps to protect your data and maintain trust.

The fact that they are providing updates, like the one about the security incident, shows a commitment to openness and keeping their customers informed. This kind of transparency can help build confidence, as it lets people know that the company is actively addressing any issues and prioritizing their safety. It’s about making sure that when you log in to manage your Erie Insurance account, you can do so with peace of mind, knowing your information is being looked after.

So, from getting a good rate on your protection to having local help, and even getting quick support for car troubles, Erie Insurance aims to make things straightforward. They offer different types of coverage for your life, home, business, and car, trying to provide good value across the board. You can connect with them by finding a local agent or by starting a price estimate online, which gives you options for how you begin. For managing your account, they’ve worked to restore online access, including bill payment, making it easier to handle your policy details. If you need to make changes or cancel, your local agent is there to assist. And for those unexpected moments like a cracked windshield or needing roadside help, there are clear ways to get assistance, either by calling, using their app, or going online. They are also working to ensure your account is safe and secure, showing their ongoing commitment to your peace of mind.

Home | Erie Insurance

Erie Insurance

Erie Insurance